Are you a new homebuyer in Farmington Hills struggling to navigate the complex world of home loans and mortgage brokers? This guide is designed to help you understand the local real estate market, explore available mortgage programs, and learn how to improve your chances of loan approval. We’ll walk you through the process of choosing a reliable mortgage broker, managing your credit history and debt, and ultimately closing the deal on your new home. With the right knowledge and preparation, you can confidently tackle the home buying process and secure the best interest rates from lenders in Farmington Hills.

Understanding Farmington Hills Home Loans for New Buyers

As a new buyer in Farmington Hills, understanding home loans is crucial. This guide covers key steps to secure funding, explore loan types like federal housing administration options, and navigate Michigan’s mortgage regulations. Your broker will help you prepare for your first home purchase and explain potential benefits of a home equity line of credit. Let’s delve into the essentials of Farmington Hills home loans.

Prepare for Your First Home Purchase

To prepare for your first home purchase in Farmington Hills, you need to take several key steps. Start by reviewing your credit score and financial situation, as these factors significantly impact your mortgage options. You should also research different mortgage services and connect with reputable mortgage brokers who can guide you through the process. Consider exploring various loan types, including conventional mortgages, Fannie Mae-backed loans, and home equity lines of credit. Your preparation should include:

- Assessing your credit score and financial health

- Saving for a down payment and closing costs

- Researching mortgage services and brokers in Farmington Hills

- Understanding different loan types and their requirements

- Getting pre-approved for a mortgage

Key Steps to Secure a Home Loan in Farmington Hills

To secure a home loan in Farmington Hills, you’ll need to follow several key steps. Start by contacting a loan officer who can guide you through the process and help you explore your options, including refinancing if you’re an existing homeowner. Work with a real estate agent to find the right property while simultaneously preparing your financial documents for the loan application. Remember that regulations may vary across the United States, so familiarize yourself with Michigan-specific requirements to ensure a smooth mortgage approval process.

Explore Loan Types Available to First-Time Buyers

As a first-time buyer in Farmington Hills, you have several loan types to consider. Mortgage services offer options like conventional home loans, which typically require a higher credit score and down payment. You might also qualify for a VA loan if you’re a veteran or active-duty military member, offering benefits such as no down payment and competitive interest rates. Additionally, explore reverse mortgage options for seniors or discuss potential fees associated with different loan types with your mortgage broker to find the best fit for your financial situation.

Navigate Michigan’s Mortgage Regulations

When navigating Michigan’s mortgage regulations, you’ll find that the state’s laws can impact your home loan process in Farmington Hills. You’ll need to familiarize yourself with specific requirements for property appraisals, title insurance, and closing procedures. Be sure to work with a mortgage service that offers rate comparisons and can provide a mortgage rate quote for both conventional and jumbo mortgage options. Your mortgage broker can help you understand how these regulations affect your loan application and guide you through any state-specific documentation needed for approval.

Why Choose a Mortgage Broker in Farmington Hills

Choosing a mortgage broker in Farmington Hills can simplify your home purchase process and help you achieve your dream of homeownership in the Detroit area. Brokers offer access to various loan options, including debt consolidation and money-saving opportunities. Learn how to select the right broker, what questions to ask, and understand the benefits of working with a broker versus a direct lender.

Discover How Mortgage Brokers Simplify the Process

Mortgage brokers in Farmington Hills streamline your home purchase loan process by handling the intricate details on your behalf. They assist you in obtaining a pre-approval letter, which strengthens your position when making offers. Your broker will guide you through various loan options, including business loans if you’re self-employed, and help you understand down payment requirements. By leveraging their industry connections and expertise, mortgage brokers simplify the journey to homeownership for you as a customer:

- Manage paperwork and communication with lenders

- Provide personalized advice on loan products

- Negotiate rates and terms on your behalf

- Expedite the approval process

- Offer support throughout the entire home buying journey

Selecting the Right Farmington Hills Mortgage Broker

When selecting the right Farmington Hills mortgage broker, consider MMS Mortgage Services, a reputable company with a strong track record. Look for a broker with an active NMLS license and extensive experience in the local market. Your chosen broker should offer competitive interest rates and guide you through the entire mortgage process efficiently. Ask potential brokers about their approach to customer service, their range of loan products, and how they handle challenging applications to ensure you find the best fit for your needs.

- Verify the broker’s NMLS license and credentials

- Inquire about their experience with Farmington Hills properties

- Compare interest rates and loan options offered

- Assess their communication style and responsiveness

- Read client reviews and testimonials

Questions to Ask Potential Brokers

When evaluating potential mortgage brokers in Farmington Hills, you should prepare a list of essential questions to ask. Inquire about their experience with various loan types, including conventional, FHA, and VA loans. Ask about their process for obtaining insurance and handling property taxes. Request details on how they guide clients through the mortgage process, from application to closing. Discuss their strategies for securing competitive rates and their approach to addressing challenges that may arise during the loan approval process:

Mortgage Broker vs. Direct Lender: Making the Best Choice

When deciding between a mortgage broker and a direct lender in Farmington Hills, consider your specific lending needs and financial situation. Mortgage brokers offer access to multiple lenders, potentially securing you a better rate quote and payment terms. Direct lenders, on the other hand, may provide a streamlined process if you have excellent credit. In Michigan, brokers can help navigate state-specific regulations and offer personalized advice, especially valuable if you’re juggling other debts like credit card balances.

Top Mortgage Programs Available in Farmington Hills

Discover the top mortgage programs in Farmington Hills tailored for new buyers. You’ll learn about first-time buyer incentives, low down payment options, and government-backed loans like FHA, VA, and USDA. Understand how credit affects your choices and explore various lenders for your home purchase or investment. Grasp interest rates and terms to make an informed decision on your mortgage.

Learn About First-Time Buyer Incentives

As a first-time buyer in Farmington Hills, you can benefit from various incentives designed to make homeownership more accessible. Your mortgage loan options may include down payment assistance programs and favorable interest rates based on your income. Some lenders offer special refinancing terms for first-time buyers, allowing you to potentially access cash for home improvements or other needs. Consult with MMS Mortgage Services to explore these incentives and find the best mortgage program for your unique situation.

Understand Low Down Payment Options

You can explore low down payment options in Farmington Hills that cater to various financial situations. Some credit unions offer programs requiring as little as 3% down, making homeownership more attainable. Your credit score plays a crucial role in determining your eligibility for these programs, so it’s essential to work on improving your credit before applying. MMS Mortgage Services can guide you through the available options and help you find a low down payment program that aligns with your financial goals and credit profile.

Government-Backed Loans: FHA, VA, and USDA

In Farmington Hills, you have access to several government-backed loan options that can make homeownership more accessible. The Federal Housing Administration (FHA) loans offer lower down payments and more flexible credit requirements, making them ideal for first-time buyers. If you’re a veteran or active-duty military member, VA loans provide excellent benefits, including no down payment and competitive interest rates. For rural properties in certain areas near Farmington Hills, USDA loans might be an option, offering 100% financing to eligible buyers. MMS Mortgage Services can help you navigate these programs and determine which best suits your needs.

Grasp Interest Rates and Terms in Farmington Hills

Understanding interest rates and terms in Farmington Hills is crucial for making informed decisions about your mortgage. You’ll find that rates can vary based on factors like your credit score, loan type, and market conditions. MMS Mortgage Services can provide you with current rate information and help you compare fixed-rate and adjustable-rate mortgages. Consider the loan term as well, as it affects your monthly payments and total interest paid over time:

Tips to Get Approved for a Home Loan

To increase your chances of home loan approval in Farmington Hills, focus on improving your credit score, managing your debt-to-income ratio, gathering necessary documentation, and avoiding common application mistakes. These key steps will help you present a strong financial profile to lenders and secure better rates for your mortgage.

Improve Your Credit Score for Better Rates

To improve your credit score and secure better rates for your Farmington Hills home loan, focus on timely payments and reducing your credit utilization. Pay down existing debts, especially high-interest credit card balances, and avoid opening new credit accounts before applying for a mortgage. MMS Mortgage Services can provide guidance on specific steps to boost your credit score, potentially leading to more favorable interest rates and loan terms for your home purchase.

Manage Your Debt-to-Income Ratio

Managing your debt-to-income ratio is crucial when applying for a home loan in Farmington Hills. You should aim to keep your total monthly debt payments below 43% of your gross monthly income. To improve this ratio, focus on paying down existing debts and avoid taking on new financial obligations before applying for a mortgage. MMS Mortgage Services can help you assess your current debt-to-income ratio and provide strategies to optimize it for better loan approval chances:

- Calculate your current debt-to-income ratio

- Identify high-interest debts to prioritize for repayment

- Consider consolidating debts to lower monthly payments

- Explore options to increase your income

- Avoid major purchases or new credit applications before seeking a mortgage

Gather Necessary Documentation

To streamline your home loan approval process in Farmington Hills, gather all necessary documentation before applying. You’ll need to provide recent pay stubs, W-2 forms, tax returns, bank statements, and asset information. MMS Mortgage Services can guide you through the specific requirements, ensuring you have all the paperwork ready to support your loan application. By being prepared with comprehensive documentation, you’ll demonstrate financial stability and increase your chances of a smooth approval process.

Avoid Common Application Mistakes

When applying for a home loan in Farmington Hills, avoid common mistakes that could hinder your approval. Double-check all information for accuracy before submitting your application. Don’t make large deposits or withdrawals without explanation, as these can raise red flags. Maintain consistent employment and avoid changing jobs during the application process. MMS Mortgage Services can help you navigate potential pitfalls and ensure a smooth application process:

Navigating the Farmington Hills Real Estate Market

Navigating the Farmington Hills real estate market requires understanding current trends, working with a local agent, making competitive offers, and arranging inspections. You’ll learn how to analyze market conditions, find a reliable agent, craft strong offers, and ensure thorough property evaluations. These steps will help you make informed decisions in your home buying journey.

Understand Current Market Trends

To understand current market trends in Farmington Hills, you need to analyze local real estate data and economic indicators. MMS Mortgage Services can provide you with up-to-date information on average home prices, days on market, and inventory levels. By staying informed about these trends, you can make more strategic decisions when applying for a mortgage and searching for your new home:

- Monitor median home prices and price-per-square-foot trends

- Track the average time homes spend on the market

- Assess the current inventory of available homes

- Compare interest rates offered by different lenders

- Consider seasonal fluctuations in the Farmington Hills market

Work With a Local Real Estate Agent

Working with a local real estate agent in Farmington Hills can significantly enhance your home buying experience. Your agent will provide invaluable insights into neighborhood dynamics, property values, and local market trends that you might not find online. They can also coordinate with MMS Mortgage Services to ensure your home search aligns with your pre-approved mortgage amount, helping you focus on properties within your budget and saving you time in your search.

Make a Competitive Offer on Your Dream Home

To make a competitive offer on your dream home in Farmington Hills, work closely with your real estate agent and MMS Mortgage Services. Your agent will help you analyze comparable sales in the area to determine a fair offer price. Ensure your offer includes a pre-approval letter from MMS Mortgage Services, demonstrating your financial readiness to the seller. Consider including contingencies for home inspection and appraisal to protect your interests while keeping the offer attractive.

Arrange for Home Inspections and Appraisals

When arranging home inspections and appraisals in Farmington Hills, you’ll need to coordinate with your real estate agent and MMS Mortgage Services. Schedule a comprehensive home inspection to identify any potential issues with the property. Your lender will require an appraisal to confirm the home’s value aligns with the loan amount. Be prepared for the following steps in this process:

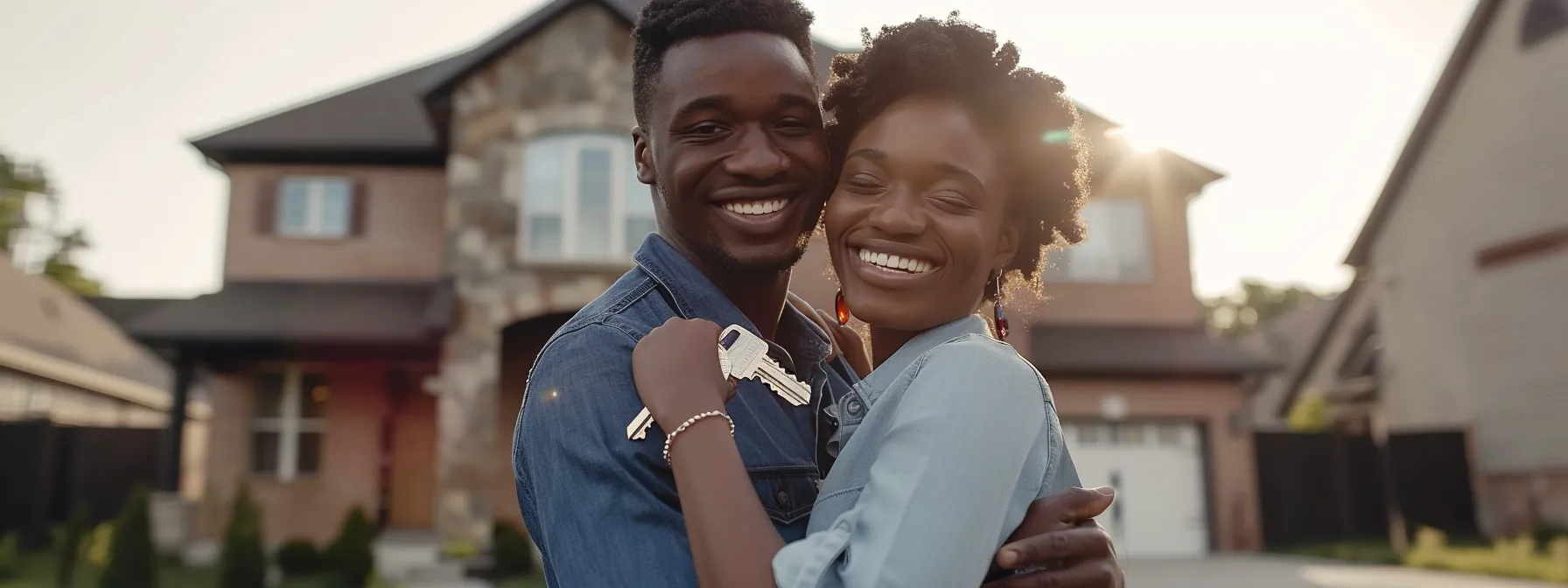

Closing the Deal: Steps to Homeownership in Farmington Hills

As you approach homeownership in Farmington Hills, understanding the final steps is crucial. You’ll need to grasp closing costs and fees, secure homeowners insurance, and prepare for closing day. Once you’ve completed these steps, you’ll be ready to move into your new Farmington Hills home. Let’s explore each stage to ensure a smooth transition to homeownership.

Understand Closing Costs and Fees

When closing on your Farmington Hills home, you’ll encounter various costs and fees. These typically include lender fees, title insurance, appraisal costs, and property taxes. MMS Mortgage Services can provide a detailed breakdown of these expenses, helping you budget accurately for your home purchase. Be sure to review your Loan Estimate and Closing Disclosure carefully, as these documents outline all the costs associated with your mortgage and home purchase.

Secure Homeowners Insurance

Securing homeowners insurance is a crucial step in closing your Farmington Hills home purchase. You’ll need to shop around for policies that offer adequate coverage for your new property, considering factors like replacement cost and liability protection. MMS Mortgage Services can recommend trusted insurance providers in the area, helping you find a policy that meets both your lender’s requirements and your personal needs. Remember to provide proof of insurance to your lender before closing day to ensure a smooth final transaction.

Know What to Expect on Closing Day

On closing day in Farmington Hills, you’ll sign numerous documents to finalize your home purchase. You should bring a valid photo ID, proof of homeowners insurance, and any required funds for closing costs. MMS Mortgage Services will guide you through each document, explaining their purpose and importance. Be prepared to spend a few hours at the closing, reviewing and signing paperwork before receiving the keys to your new home.

Moving Into Your New Farmington Hills Home

After closing on your Farmington Hills home, you’ll need to prepare for the move. Contact utility companies to set up services in your name and schedule your move-in date. MMS Mortgage Services can provide a checklist of local utilities and services to help you get settled. Consider updating your address with the post office, employers, and financial institutions to ensure a smooth transition to your new home.

Navigating the Home Loan Process with MMS Mortgage Services

Navigating the home loan process in Farmington Hills is crucial for new buyers, requiring a thorough understanding of mortgage options, market trends, and local regulations. Working with a reputable mortgage broker like MMS Mortgage Services can simplify the journey, providing access to competitive rates, personalized advice, and assistance throughout the entire home buying process. By improving your credit score, managing your debt-to-income ratio, and gathering necessary documentation, you can increase your chances of loan approval and secure better terms. Ultimately, with the right guidance and preparation, you can confidently close the deal on your dream home in Farmington Hills and embark on your journey to homeownership. Contact MMS Mortgage Services at (248) 788-0800 to schedule your consultation.